Do you want to learn how to become financially literate? If your answer is yes, then you’re in the right place.

Introduction: How to Become Financially Literate

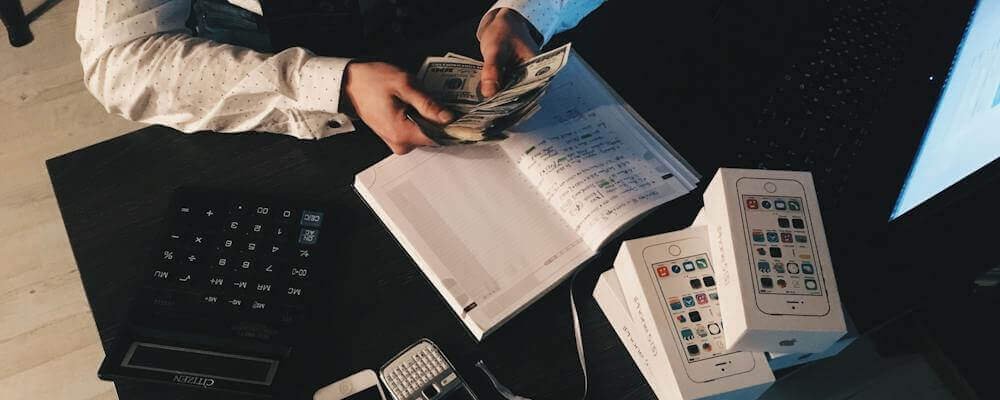

Embarking on a journey towards financial literacy is akin to obtaining a compass for life’s financial decisions.

Understanding how money works and navigating the terrain of investments, savings, debt, and retirement planning is crucial.

Here, we delve into the essentials of mastering financial literacy.

Table of Contents

Understanding Financial Basics

Embarking on a journey towards financial literacy is akin to obtaining a compass for life’s financial decisions. Understanding how money works and navigating the terrain of investments, savings, debt, and retirement planning is crucial. Here, we delve into the essentials of mastering financial literacy.

Importance of Budgeting

Budgeting stands as the bedrock of financial stability, orchestrating a roadmap for fiscal success. It goes beyond mere expense tracking, fostering disciplined spending habits, and aligning financial goals.

By meticulously allocating income, it ensures priorities are met, curbs unnecessary expenses, and allows for strategic saving.

It serves as a financial guardian, enabling individuals to weather unforeseen circumstances, achieve aspirations, and build a safety net for the future.

Embracing budgeting isn’t just about numbers; it’s a cornerstone for a prudent and empowered financial lifestyle, offering control, clarity, and a path towards long-term financial security.

Basics of Savings

Mastering the Basics of Savings is akin to laying the cornerstone of financial resilience. It involves cultivating a mindset of setting aside a portion of earnings regularly, fostering a habit that transcends fleeting desires.

Savings act as a buffer against the unexpected, forming a safety net for emergencies and future aspirations.

Understanding the art of saving entails not just accumulating funds but making strategic choices, balancing immediate needs with long-term goals.

It’s about embracing prudence, discipline, and a forward-thinking approach, ensuring financial stability while empowering individuals to navigate life’s uncertainties with confidence and preparedness.

Understanding Credit Scores

Understanding credit scores is pivotal in unraveling the financial tapestry. It involves grasping the numerical representation of one’s creditworthiness, dictating borrowing potential and interest rates.

A higher score signifies reliability, opening doors to better loan terms, while a lower score poses challenges.

Diving deeper involves comprehending the factors shaping these scores—payment history, credit utilization, length of credit history, and more.

It’s not just about the number but the financial narrative it weaves, impacting opportunities for mortgages, loans, and even employability.

Cultivating a healthy score demands vigilance, timely payments, and strategic credit management, underlining its pivotal role in financial landscapes.

Importance of Emergency Funds

The Importance of emergency funds transcends being a mere financial cushion; it’s a shield against life’s unexpected storms. These funds act as a lifeline during unforeseen crises, be it sudden job loss, medical emergencies, or unexpected home repairs.

They serve as a safety net, averting reliance on loans or credit cards, ensuring financial stability during turbulent times. Building and maintaining an emergency fund isn’t just a precaution; it’s a proactive step towards financial resilience.

It empowers individuals to weather the unexpected, offering peace of mind and a sense of security, enabling them to navigate uncertainties with confidence and stability.

Investing for the Future

Investing for the Future involves strategic allocation of resources into various vehicles such as stocks, bonds, and real estate.

It’s about optimizing returns while managing risks, fostering financial growth, and building a secure foundation for tomorrow’s aspirations and financial goals.

Different Investment Vehicles

Diverse investment vehicles offer unique pathways to grow wealth. From traditional options like stocks and bonds to alternative choices such as real estate or mutual funds, each presents varying risk and return profiles.

Stocks signify ownership in companies, while bonds are debt securities. Real estate offers tangible property investments. Exploring these vehicles allows diversification, balancing risks across different assets.

Understanding these options empowers investors to tailor portfolios aligning with their risk tolerance and financial objectives.

Deciphering the nuances helps in crafting a strategic investment plan, optimizing returns, and navigating the dynamic landscape of financial markets with informed choices.

Risks and Returns

Risks and returns form the seesaw of investment landscapes. While higher returns beckon, they often accompany higher risks.

Understanding this trade-off is pivotal. Risks encompass market volatility, economic fluctuations, and company-specific challenges. Returns, on the other hand, denote the gains expected from investments.

Balancing these elements involves assessing personal risk tolerance against potential gains, crafting a diversified portfolio to mitigate risks while maximizing returns.

It’s about finding the sweet spot – embracing risks that align with goals, fostering growth, and ensuring prudent decision-making in the pursuit of financial prosperity.

Building an Investment Portfolio

Building an Investment Portfolio is akin to crafting a personalized financial roadmap. It involves strategically blending diverse assets – stocks, bonds, real estate, and more – tailored to individual goals and risk tolerance.

The aim is to optimize returns while minimizing risks through diversification. Crafting this mosaic demands meticulous research, balancing high and low-risk assets, and periodic rebalancing.

It’s about aligning investments with short-term needs and long-term aspirations, ensuring stability and growth.

A well-built portfolio isn’t just a collection of assets; it’s a dynamic, evolving strategy that adapts to market changes, empowering individuals to navigate financial terrains with resilience and confidence.

Debt Management and Avoidance

Debt Management is a pivotal financial skill, involving prudent handling of debts to secure financial health.

It encompasses strategies to minimize and effectively handle debts, distinguishing between beneficial and burdensome debts, ultimately striving towards a debt-free financial state.

Types of Debt

Debt manifests in various forms, each with distinct characteristics and implications on personal finances. Mortgage Loans constitute the most substantial debt for many, facilitating property purchases. These loans often span several years, with fixed or adjustable interest rates.

Student Loans cater to educational expenses, enabling individuals to pursue higher education. They come with diverse repayment plans and interest rates, often impacting long-term financial health.

Credit Card Debt arises from using credit cards for purchases, leading to revolving balances subject to high-interest rates. Unchecked credit card debt can spiral, affecting credit scores and financial stability.

Personal Loans encompass a wide range of borrowing, from financing home renovations to consolidating debts. They offer flexibility in terms but require disciplined repayment.

Auto Loans facilitate vehicle purchases, spreading the cost over a designated period. They may carry variable interest rates based on credit scores and loan terms.

Understanding the nuances of these debts is crucial. Mortgage and student loans often serve as investments in assets (homes or education), potentially enhancing future wealth.

On the contrary, credit card debt and certain personal loans may not yield long-term value, requiring prudent management to avoid financial strain.

Navigating debt involves prioritizing repayment, distinguishing between ‘good’ debts that contribute to future wealth and ‘bad’ debts that burden finances.

Strategically managing debts empowers individuals to maintain financial health, seize opportunities, and build a secure financial foundation.

Debt Management Strategies

Debt management strategies encompass various approaches to tackle and alleviate debts. The Snowball Method involves prioritizing smaller debts for quicker repayment, building momentum. In contrast, the Avalanche Method targets high-interest debts first to minimize long-term costs.

Debt Consolidation merges multiple debts into a single payment, often with a lower interest rate.

Budgeting and disciplined spending curb unnecessary expenses, channeling funds towards debt repayment. Seeking professional guidance or negotiating with creditors for better terms are also effective strategies.

Employing these methods strategically aids in debt reduction, paving the way for financial freedom and stability.

Avoiding Debt Pitfalls

Avoiding debt pitfalls demands astute financial acumen. It involves steering clear of impulsive borrowing, prioritizing needs over wants, and shunning unnecessary debts.

Discipline in budgeting and spending curbs unnecessary expenses, preventing debt accumulation. Avoiding maxing out credit cards and paying only minimum balances prevents snowballing debt.

Prudent financial planning ensures emergency funds are in place, mitigating reliance on loans during crises. Careful scrutiny of borrowing terms, understanding interest rates, and reading fine print before committing to debts are vital.

Staying vigilant against overspending, embracing financial discipline, and fostering a mindset of conscious borrowing are key strategies to sidestep debt pitfalls and secure a stable financial future.

Planning for Retirement

Planning for retirement demands foresight. It involves exploring diverse retirement accounts, strategizing early, and aligning investments with future needs.

Starting early harnesses the power of savings and compounding, ensuring a secure and comfortable retirement phase.

Retirement Accounts

Retirement Accounts offer diverse avenues for savings and investment, vital for securing one’s post-work life. Options like 401(k)s and IRAs provide tax advantages, allowing individuals to contribute regularly.

These accounts facilitate investment growth, ensuring a financial cushion during retirement.

Selecting the right account involves assessing tax implications, contribution limits, and withdrawal rules, aligning with personal retirement goals.

Choosing between traditional or Roth accounts depends on tax preferences, guiding the trajectory of retirement savings and financial security in the golden years.

Strategies for Retirement Planning

Strategies for retirement planning entail meticulous foresight and tailored approaches. Crafting a robust plan involves setting clear financial goals, estimating future expenses, and devising savings milestones.

Utilizing retirement calculators aids in projecting needs and adjusting contributions accordingly. Diversifying investments across stocks, bonds, and other assets balances risk and potential returns.

Regular reviews and adjustments to the plan accommodate life changes and market fluctuations, ensuring the plan stays aligned with evolving goals.

Early planning, disciplined saving, and strategic investment choices empower individuals to navigate retirement years with financial confidence and peace of mind.

Importance of Starting Early

Starting early in financial planning forges a profound impact on long-term outcomes. Commencing investments or savings at a younger age harnesses the advantage of time, leveraging the power of compounding.

It allows smaller contributions to grow substantially over time due to accrued interest or investment returns.

Early initiations provide a cushion against market fluctuations, enabling gradual adjustments. Moreover, it offers flexibility for riskier investments and higher growth potential.

By initiating financial actions sooner, individuals secure a robust financial foundation, ensuring ample time to meet goals, and fostering a financially secure future with greater stability and flexibility in later years.

Real-World Applications of Financial Literacy

Real-World Applications of Financial Literacy involve applying money management skills in daily life, making informed financial decisions, budgeting wisely, and navigating financial challenges for long-term stability and success.

Financial Literacy in Everyday Life

Financial literacy in everyday life encapsulates applying fiscal wisdom to routine actions, encompassing budgeting, wise spending, and conscious financial decisions.

It’s about deciphering financial jargon, making informed purchases, and optimizing resources for savings. From grocery shopping with a list to negotiating better deals, these practices foster prudence.

Smart budgeting allows for regular savings, while understanding interest rates aids in choosing loans or credit cards wisely. Moreover, it involves comprehending insurance options and investing sensibly for future security.

Integrating financial literacy into daily routines empowers individuals to navigate financial challenges, build resilience, and secure a sound financial footing.

Teaching Financial Literacy

Teaching financial literacy involves imparting crucial money management skills, empowering individuals to make informed financial decisions.

It encompasses educational programs, workshops, and mentorship initiatives, educating on budgeting, saving, investing, and debt management.

By instilling financial literacy early, it cultivates a generation adept at handling finances. It’s about demystifying financial concepts, discussing real-life scenarios, and offering practical tools for effective money management.

Encouraging discussions on loans, credit, and investments equips individuals to navigate financial terrains confidently.

Teaching financial literacy isn’t just about imparting knowledge; it’s about nurturing a mindset of fiscal responsibility and empowerment for long-term financial well-being.

Financial Literacy Resources

Financial literacy resources encompass a vast array of tools and materials aiding in understanding and managing finances. These include books, podcasts, online courses, and credible websites offering comprehensive financial education.

Libraries house a wealth of literature on personal finance, while reputable online platforms provide interactive courses and informative articles.

Financial institutions offer guidance through seminars or workshops, aiding in investment strategies and debt management. Educational websites offer calculators and guides, empowering individuals to make informed decisions.

These resources cater to diverse learning styles and levels of expertise, fostering continuous learning and serving as indispensable aids in enhancing financial literacy for a secure financial future.

Conclusion

In conclusion, embarking on the journey to become financially literate is not a destination but a continuous process of growth and empowerment. Mastering the essentials – budgeting, savings, investments, debt management, and retirement planning – forms the cornerstone of a secure financial future. Each aspect of financial literacy serves as a puzzle piece contributing to a comprehensive understanding of money matters.

As we navigate the complexities of financial landscapes, it becomes apparent that the power lies in knowledge. From understanding the nuances of credit scores to strategically building an investment portfolio, each step is a stride towards financial freedom. Real-world applications of financial literacy come alive in everyday decisions, teaching us to be conscious consumers and prudent spenders.

Teaching and sharing financial literacy not only strengthen personal financial foundations but also contribute to building a financially savvy community. The importance of starting early becomes evident in the compounding effect, emphasizing the significance of initial financial actions.

In this ever-evolving financial realm, utilizing diverse resources and staying informed is key. Financial literacy resources, from books to online courses, serve as guides on this journey. Embracing financial literacy is about more than managing money; it’s about gaining control, making informed decisions, and securing a prosperous and resilient financial future.

Remember, financial literacy is not just a skill; it’s a tool that empowers, enlightens, and ensures a path to lasting financial well-being.

Frequently Asked Questions

Q: How can I start improving my financial literacy?

A: Begin by reading financial literature, attending workshops, or consulting a financial advisor to kickstart your journey.

Q: Is it necessary to hire a financial advisor for financial literacy?

A: While not mandatory, a financial advisor can offer tailored guidance and strategies aligned with your financial goals.

Q: Can anyone become financially literate regardless of their income level?

A: Absolutely! Financial literacy is about understanding and managing money effectively, irrespective of income levels.

Q: What are some common mistakes to avoid while improving financial literacy?

A: Avoid overlooking budgeting, neglecting emergency funds, and making impulsive investment decisions without research.

Q: How does financial literacy benefit individuals in the long run?

A: It empowers individuals to make informed financial decisions, secure their future, and attain financial independence.

Q: Where can I find reliable resources to enhance my financial literacy?

A: Reputable online platforms, libraries, financial institutions, and educational websites offer a plethora of reliable resources.